What Is The Cost Of Living In Hawaii? Discover The True Expenses Of Paradise

Hawaii is known for its stunning landscapes, vibrant culture, and laid-back island lifestyle, but living in paradise comes at a price. The cost of living in Hawaii is one of the highest in the United States, and understanding its intricacies is crucial for anyone considering a move or planning a long-term stay. From housing and groceries to transportation and healthcare, the expenses in Hawaii can significantly impact your financial planning. In this guide, we’ll explore the factors contributing to Hawaii's high cost of living and provide actionable insights to help you navigate this unique environment.

Living in Hawaii offers a unique blend of natural beauty and cultural richness, but it also requires careful financial consideration. The state’s geographic isolation plays a major role in driving up costs, as many goods and services must be imported. This means higher prices for everyday essentials like food, fuel, and household items. Additionally, the demand for housing in Hawaii’s limited land area has created a competitive real estate market, making homeownership a significant investment. Understanding these dynamics is essential for anyone asking, "What is the cost of living in Hawaii?"

Whether you’re a prospective resident, a retiree, or simply curious about the expenses in this tropical paradise, this article will provide a detailed breakdown of what to expect. We’ll delve into specific costs, compare them to the mainland U.S., and offer practical advice for managing your budget in Hawaii. By the end of this guide, you’ll have a clear understanding of the financial realities of living in one of the world’s most beautiful destinations.

Read also:Does Hwang In Yeop Have A Wife Unveiling The Truth About The Rising Star

Table of Contents

- What is the Cost of Living in Hawaii?

- Why is Hawaii So Expensive?

- What Are the Housing Costs in Hawaii?

- How Much Do Groceries and Dining Cost?

- What Are the Transportation Costs in Hawaii?

- How Much Does Healthcare Cost in Hawaii?

- What Are the Utility Costs in Hawaii?

- What Are the Costs of Education and Childcare?

- How Can You Save Money in Hawaii?

- Final Thoughts on the Cost of Living in Hawaii

What is the Cost of Living in Hawaii?

When people ask, "What is the cost of living in Hawaii?" they are often surprised by the answer. Hawaii consistently ranks as one of the most expensive states in the U.S. due to its unique geographic and economic conditions. The cost of living index in Hawaii is approximately 80% higher than the national average, with housing, groceries, and utilities being the most significant contributors to this figure.

For example, a single person’s estimated monthly expenses in Hawaii can range from $3,000 to $4,500, depending on their lifestyle and location. Families may need to budget even more, especially if they have children or require additional services like childcare or healthcare. Understanding these costs is essential for anyone planning to relocate or retire to Hawaii.

Why is Hawaii So Expensive?

Hawaii’s high cost of living can be attributed to several key factors. First and foremost is its geographic isolation. As an archipelago in the middle of the Pacific Ocean, Hawaii relies heavily on imports for most goods, from fresh produce to building materials. This reliance on shipping drives up prices significantly.

Another factor is the limited availability of land. With only 6,423 square miles of land spread across eight main islands, space is at a premium. This scarcity drives up real estate prices, making housing one of the largest expenses for residents. Additionally, Hawaii’s popularity as a tourist destination creates high demand for goods and services, further inflating costs.

What Are the Housing Costs in Hawaii?

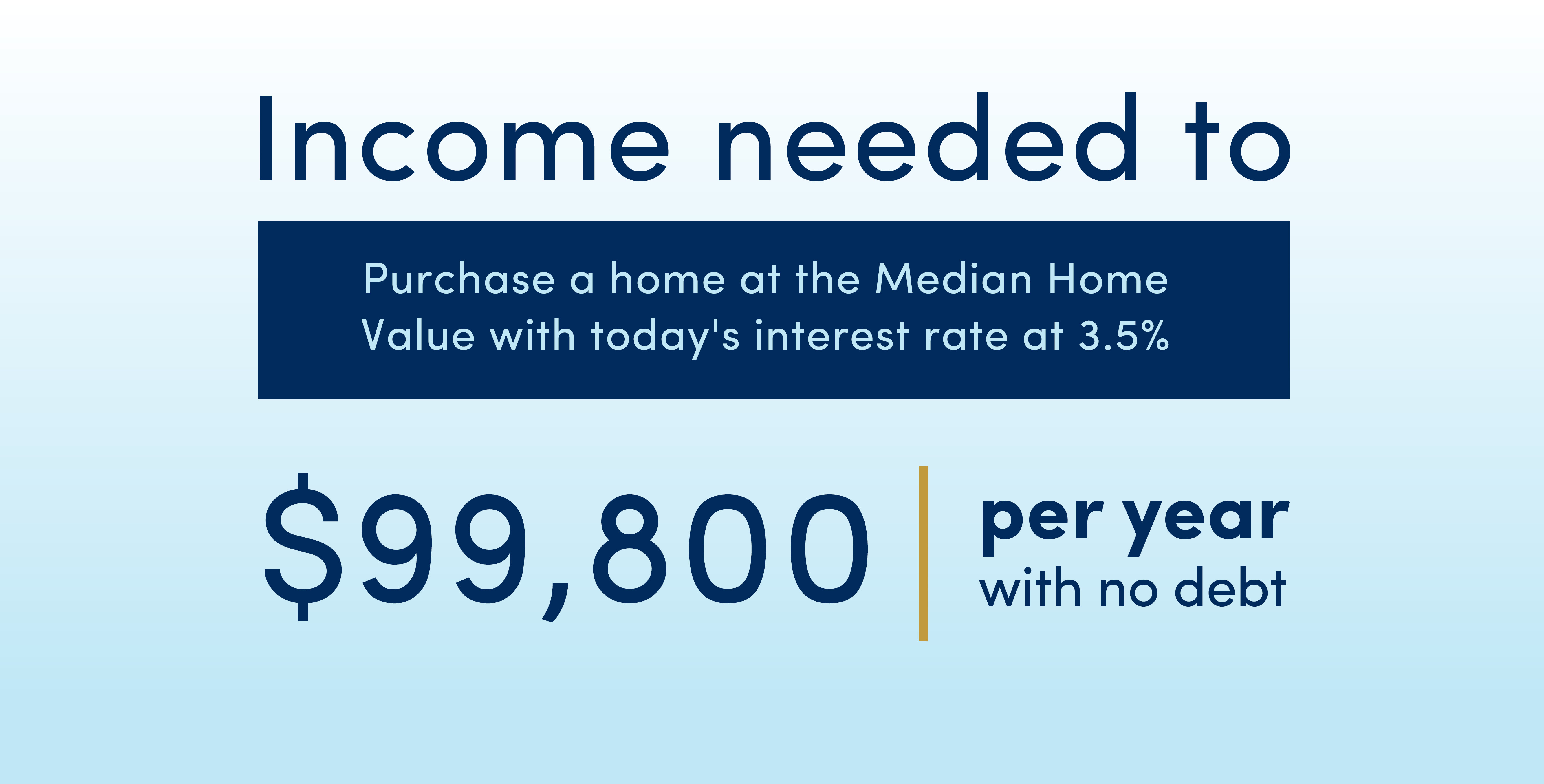

Housing is by far the largest expense for most residents in Hawaii. The median home price in Hawaii is significantly higher than the national average, often exceeding $800,000. Renters face similarly steep costs, with the average monthly rent for a one-bedroom apartment in Honolulu hovering around $2,500.

Here are some factors that contribute to Hawaii’s high housing costs:

Read also:Lady Gagas Iconic Looks A Journey Through Her Bold And Unforgettable Fashion Choices

- Limited land availability

- High demand from both residents and tourists

- Construction costs due to imported materials

How Much Do Groceries and Dining Cost?

Groceries in Hawaii are notoriously expensive, with prices often 50-60% higher than on the mainland. This is primarily due to the cost of importing food and the limited availability of local produce. A gallon of milk, for example, can cost $6 or more, while fresh fruits and vegetables are often priced significantly higher than elsewhere in the U.S.

Dining out in Hawaii is also costly, with the average meal at a mid-range restaurant costing around $20-$30 per person. However, many locals and tourists alike find the island’s diverse culinary scene worth the expense.

What Are the Transportation Costs in Hawaii?

Transportation in Hawaii is another area where residents face higher-than-average expenses. Gas prices are consistently higher than the national average, often exceeding $4 per gallon. Additionally, vehicle registration fees and insurance costs are elevated due to the state’s unique risks, such as hurricanes and theft.

Public transportation options are limited, particularly outside of Oahu, making car ownership almost essential. For those who rely on public transit, the cost is relatively affordable but may not be convenient for all areas.

How Much Does Healthcare Cost in Hawaii?

Healthcare in Hawaii is another significant expense, though it is often more affordable than in other high-cost states like California or New York. The state’s employer-mandated health insurance program, known as the Prepaid Health Care Act, ensures that most residents have access to coverage. However, out-of-pocket costs for medical services, prescriptions, and specialist care can still add up quickly.

For retirees or those on a fixed income, understanding healthcare costs is crucial. Medicare and supplemental insurance plans are widely used, but additional expenses for dental and vision care should also be considered.

What Are the Utility Costs in Hawaii?

Utility costs in Hawaii are generally higher than the national average, particularly for electricity. This is due to the state’s reliance on imported fossil fuels for energy production. Residents can expect to pay around $0.30-$0.40 per kilowatt-hour, compared to the national average of $0.13.

Other utility costs, such as water and internet, are relatively comparable to mainland prices. However, air conditioning is rarely needed due to Hawaii’s mild climate, which can help offset some energy expenses.

What Are the Costs of Education and Childcare?

Education and childcare are additional considerations for families in Hawaii. Public schools are available, but many parents opt for private education due to concerns about overcrowding and quality. Private school tuition can range from $5,000 to $20,000 per year, depending on the institution.

Childcare costs are also high, with full-time daycare averaging $1,200-$1,500 per month. For families with young children, these expenses can significantly impact their overall budget.

How Can You Save Money in Hawaii?

While the cost of living in Hawaii is undeniably high, there are ways to manage expenses and make life more affordable. Here are some tips:

- Buy locally grown produce at farmers' markets to save on groceries.

- Consider carpooling or using public transportation to reduce fuel costs.

- Take advantage of free or low-cost outdoor activities, such as hiking and beach days.

- Shop at second-hand stores for clothing and household items.

Final Thoughts on the Cost of Living in Hawaii

Living in Hawaii offers unparalleled beauty and a unique lifestyle, but it comes with a high price tag. Understanding "what is the cost of living in Hawaii" is the first step toward making an informed decision about whether this paradise is the right fit for you. By planning carefully and adopting cost-saving strategies, it’s possible to enjoy all that Hawaii has to offer without breaking the bank.

Whether you’re drawn to Hawaii’s beaches, culture, or community spirit, knowing the financial realities will help you prepare for the journey ahead. With the right mindset and resources, you can embrace the Aloha spirit while maintaining a balanced budget.

Is Fungi Autotrophic Or Heterotrophic? Unraveling The Mystery Of Fungal Nutrition

Exploring The Price Of Living In Hawaii: A Comprehensive Guide

Fornite Default Skin: A Complete Guide To The Iconic Look

Cost of Living in Hawaii 2023

Cost Of Living In Hawaii 2022 Your Handy Guide